PEI Parents Stuck as Child's RESP Plummets into Limbo After Name Change Mishap

The Impact of a Minor Typo on an Education Savings Plan

Technology has revolutionized the way we handle our finances. From checking balances to making transactions, everything is now just a few taps away. However, this convenience can sometimes come with unexpected challenges. A family from Prince Edward Island (P.E.I.) is currently facing a frustrating situation due to a minor mistake that has had significant consequences.

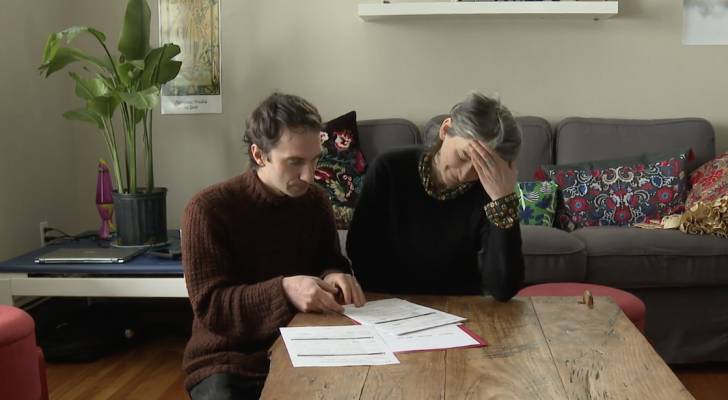

Max Deller-Lestage and his wife, Marie Pascal, opened a Registered Education Savings Plan (RESP) at TD Bank for their two children, who share the surname Pascal Deller-Lestage. When filling out the digital form, they encountered an issue: the children's full name didn't fit into the designated space. TD Bank decided to remove the hyphen and space from the last name to make it fit, which led to complications down the line.

The Consequences of a Small Change

Later, the couple attempted to transfer the RESP to a different bank to secure a better interest rate. However, they faced obstacles because the new institution used the children's full legal names, which did not match the adjusted surname that TD had used. This discrepancy caused the transfer to stall, leaving the family’s funds tied up with TD for over a year.

Deller-Lestage explained that the issue could have been resolved if it were escalated to someone with the authority to fix it. Unfortunately, local branches were unsure how to proceed, and each time he tried to explain the situation, he was told to wait for a response, often after several weeks.

The Role of Technology in Financial Management

The couple believes that the delay might be due to a combination of "overreliance on technology" and the amount of money held in the RESP, which currently stands at $6,000. While TD Bank has not provided a comment, it has stated that it is examining the issue and prioritizing remediation as soon as possible.

One of the main complications is that the family cannot simply withdraw the money themselves and deposit it into a new RESP. Doing so would disqualify their children from receiving the Canada Education Savings Grant (CESG), which adds around $1,000 to the account.

The Importance of RESPs

RESPs are a popular choice for Canadians saving for their children's post-secondary education. As of 2024, nearly $90 billion in assets are held in these accounts. There are several reasons for this:

- Tax-Deferred Growth: Any money saved in an RESP is not taxed until it is withdrawn by the contributor or the beneficiary.

- Government Grants: Families using RESPs can receive government grants such as the Canada Learning Bond and the Canada Education Savings Grant, which can add significant amounts to the account.

However, these benefits come with responsibilities. Even small errors, like typos, can lead to major issues that affect grant eligibility or the ability to transfer funds.

How to Avoid Administrative Issues

To prevent similar problems, it's essential to take the following steps:

- Get Everything in Writing: If administrative changes are made, ensure you have a written explanation of the change. This can help prevent future issues.

- Double-Check Information: Before adding a new beneficiary or transferring an account, verify all information to avoid errors.

- Report Issues Immediately: If you notice an error, report it to your financial institution right away. Delaying the report may require additional documentation to correct the issue.

Final Thoughts

A minor typo turned into an administrative nightmare for Deller-Lestage and Pascal, preventing them from benefiting from a better interest rate on their RESP balance for over a year. While the amount may not be substantial, the experience highlights the importance of being cautious when dealing with small details, especially when it comes to financial matters.

By taking proactive steps and staying vigilant, individuals can avoid similar pitfalls and ensure that their financial plans remain on track.